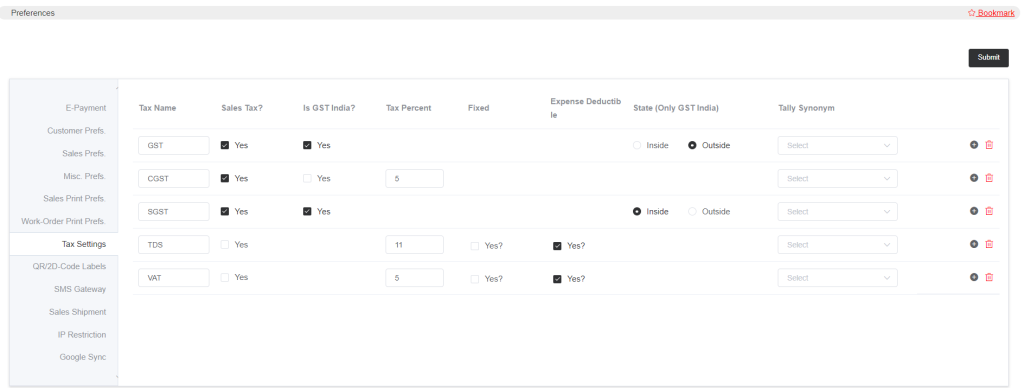

Tax Settings

Here you will be asked to add the taxes associated with your business.

For the tax settings go to Setup then Preferences and now click on Tax Settings.

- The tax name needs to be entered in the Tax Name box, and if the tax is applicable on sales, select Yes for Sales Tax.

- You can then select the yes option if your business falls under the GST India Tax. If it is not GST India Tax, enter the tax percentage of your applicable tax.

- If the tax is fixed then select Yes. Also, if you have any expenses and any tax deductions for those expenses then you can select yes for Expense Deductibles.

- For GST India clients, you can specify if the tax is applied inside or outside of the state.

- In the Tally Synonym column, you will need to select the synonyms of all the taxes that will be similar to the tally’s account category. So in the future, if you enable tally for your account and export data, then the tax categories can be reviewed in tally.

Click on submit once everything is completed.

Note that when you enable the tax settings here, then the tax option will appear wherever the tax will need to be applied.

Additional taxes can be added at this point. Adding a new one is as easy as clicking the plus sign icon.