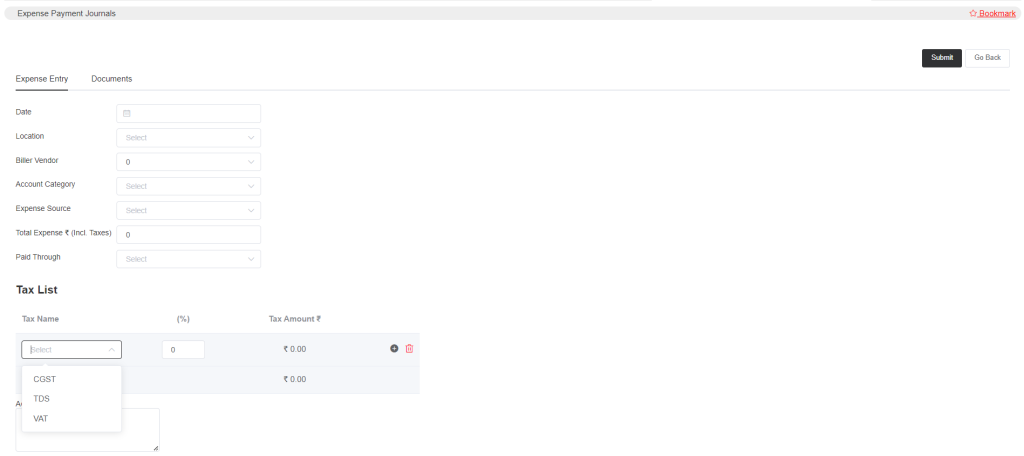

Expense Payment Journals

Here you can record all the minor expenses that you make. All the operational expenses need to be registered here. Mainly all the day-to-day expenses related to your business. For instance, fuel expenses, transportation charges, or any such contractor/labour payment.

Go to Accounts and then Expense Payment Journals.

Select the date, location, and vendor name. And if you do not want to select the vendor name, then select No Biller from the vendor list. Again, for the account categories you will need to add in the setup->accounts setup->accounts category, once the category names are there, you can select the account category, the expense source is the employee who recorded the expense. Next, enter the amount and payment mode.

In the tax list you can select the tax that will be applicable for the expense. To add the expense tax and tax percentage, go to setup->preferences->tax settings. Now submit it and the expense will be recorded.